Blog by Ben Greenberg, VP of Corporate Development at IT Solutions

If you’re considering M&A initiatives or navigating the challenges of growing your business, we invite you to connect with Ben (Benjamin.Greenberg@itsolutions-inc.com).

The managed services market was valued at nearly $300 billion in 2023, according to Grand View Research, and the growth trajectory continues its upward trend — forecast to grow by 13.6% through 2030. Given the large total addressable market (TAM) and high growth rate, private equity firms have jumped into MSP M&A over the last several years.

Attractive recurring revenue, large addressable markets, and strong growth are a powerful combination.

Sellers looking to maximize valuation should continue to see substantial opportunities in 2024. However, the most successful sellers will focus less on multiples and more on value drivers.

The TAM for SMB technology spending continues to increase, signaling growth potential for MSPs. However, with growth comes competition. MSPs face threats from new market entrants. Moreover, cybersecurity demands and other factors contribute to operational complexity and increasing costs — making scaling more difficult in today’s world.

These “impact zones” leave smaller MSPs facing tough decisions frequently:

Each of these options has pros and cons. For example, focusing on less mature clients will cap profitability and growth. For MSPs that have not yet matured their processes, acquiring other MSPs is typically a recipe for disaster. Channel partners are usually set up for larger, more mature clients.

However, most MPS owners do realize that they cannot continue the status quo without addressing business risks. The current M&A landscape reflects this dynamic.

Deal volume has increased sharply, which has also increased the chatter among owners around valuation. When I talk to owners about valuation, I often find they have it backward — multiples do not drive valuation, valuation drives multiples.

While size could drive higher multiples to a point, this is only true if the operational maturity and key value drivers warrant the result. Many MSPs struggle to scale without sound processes. For this reason, using MSP size as the key proxy for multiples is a mistake.

In addition, headlines about multiples don’t tell the full story. Sellers must examine deal structure details to understand true value. There are a variety of ways deals can be structured, which can significantly impact the headline multiple. For example:

It’s easy to get mixed messages when you see that another MSP sold for a particular multiple because of so many other factors. For example, seeing an 8X multiple really doesn’t tell you anything until you can understand the underlying deal points. RR vs TTM, earnouts, comp — it’s never as easy as it seems.

While multiples and EBITDA garner attention, key performance indicators are what truly impact MSP valuations:

MSPs have to perform to maximize valuations, and what drives performance is a disciplined operation.

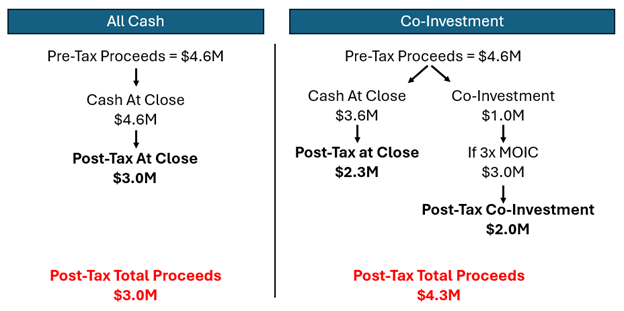

Rather than an all-cash sale, some deals enable sellers to co-invest a portion of proceeds into the buyer’s platform. This rollover capital is often invested tax-deferred and stands to gain from the buyer’s accelerated growth. It’s also a great way for sellers to de-risk what they built, be part of a larger organization, and participate in the upside — especially if you believe the buyer can build enterprise value faster than you can.

Comparing an all-cash $4.6 million sale to a $4.6 million deal with a $1 million rollover illustrates the power of co-investing.

*MOIC = Multiple on invested capital

This example shows a 43% increase in after-tax value from co-investing versus an all-cash sale. Although co-investment can be a fantastic way to maximize value for your business, sellers should be sure to understand the buyer’s growth plans and operating history when considering a rollover. Co-investing isn’t advisable in some situations.

Also, consider that co-investment does tie up cash that might be used for other investments. Sellers will want to weigh the potential upside against other alternatives.

All in all, if an owner is considering a sale, it’s important to understand the variables within their control to maximize value. Sellers should define the key performance indicators that will guide their exit and develop plans to improve those metrics. In addition, it’s important to consider important personal factors such as how you want to spend time in the future and what the most efficient way to meet personal financial objectives is.

Ready to delve deeper into the intricacies of business valuation and maximizing your company’s worth? Whether you’re exploring M&A opportunities, seeking to enhance your understanding of valuation methodologies, or navigating the complexities of business growth, we invite you to connect with Ben Greenberg, VP of Corporate Development at IT Solutions (Benjamin.Greenberg@itsolutions-inc.com).

We’ve got answers — fast, clear, and tailored to your needs. Let’s talk tech.